BerkshireHathawayLetterstoShareholders,2.epub - (EPUB全文下载)

文件大小:7.38 mb。

文件格式:epub 格式。

书籍内容:

Letters to Shareholders

By Warren E. Buffett

Introduction

Warren E. Buffett first took control of Berkshire Hathaway Inc., a small textile company, in April of 1965. A share changed hands for around $18 at the time. Fifty-three letters to shareholders later, the same share traded for $297,600, compounding investor capital at just over 20% per year—a multiplier of 16,533 times.

Buffett has said many times that he “was wired at birth to allocate capital.” By allocating resources to assets and endeavors that have the greatest potential for gain, Buffett has guided Berkshire to creating enormous value—not only for shareholders, but for the managers, employees, and customers of its holdings.

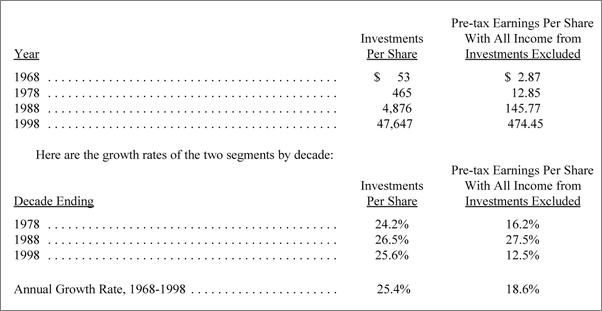

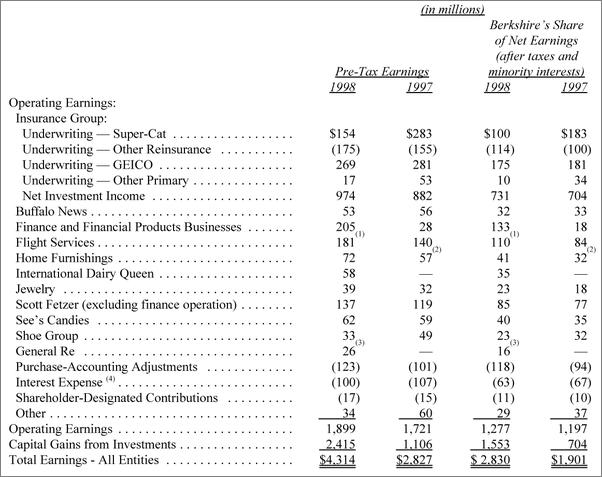

The numbers and charts you see on the following pages tell the story of a compounding machine. The rest of the book tells of the people, companies, and philosophy that have driven it for five decades.

In addition to providing an astounding case study on Berkshire’s success, Buffett shows an incredible willingness to share his methods and act as a teacher to his many students.

I put this compilation together as thanks to Warren’s positive influence on myself and many, many others.

Max Olson

March 22, 2018

Mountain View, CA

P.S. I owe a huge thanks to Tracy Britt, for working with me to finish this book, Deb Ray for scouring Warren’s archives for the information I needed, and to Guy Spier for suggesting I make the book public.

NOTES

: Formatting of letters was reproduced as close as possible to match the original. Page numbers mentioned within the letters themselves refer to pages in their original Annual Reports (available post-1994 at http://www.berkshirehathaway.com/

).

COPYRIGHT

: All of the letters in this book are written and copyrighted by Warren E. Buffett and are reproduced here with his permission. These letters must not be reproduced, copied, sold, or otherwise distributed without the permission of Warren E. Buffett.

ON THE COVER

: Mathat, Asa: Warren Buffett, Fortune’s Most Powerful Women

(2011).

Performance Chart

Annual Percentage Change

Per-Share Book Value of Berkshire

Market Price Per-Share of Berkshire

S&P 500 with

Dividends

1965

23.8%

49.5%

10.0%

1966

20.3

(3.4)

(11.7)

1967

11.0

13.3

30.9

1968

19.0

77.8

11.0

1969

16.2

19.4

(8.4)

1970

12.0

(4.6)

3.9

1971

16.4

80.5

14.6

1972

21.7

8.1

18.9

1973

4.7

(2.5)

(14.8)

1974

5.5

(48.7)

(26.4)

1975

21.9

2.5

37.2

1976

59.3

129.3

23.6

1977

31.9

46.8

............

书籍插图:

以上为书籍内容预览,如需阅读全文内容请下载EPUB源文件,祝您阅读愉快。

书云 Open E-Library » BerkshireHathawayLetterstoShareholders,2.epub - (EPUB全文下载)